Today we're going to focus on the differences between sites with and without planning conditions and how this alters the financial analysis within the development appraisal. We will touch lightly on the UK planning process, covering how development appraisals vary, and illustrating how the residual value is affected.

Consented v Unconsented Sites

A consented site is a site that has planning consent for a development project. Unconsented land is a site that has no planning consent for development.

In order to obtain the necessary consents the developer or own will have to carry out various studies and submit a planning application to the local authority.

Quick Overview of the Planning Process (UK)

In the UK guidance and policy stems from the National Planning Policy Framework.

Application fees aren't usually that expensive - the real cost comes in the form of preparing the application. These will be discussed in the sections below.

How do the appraisals differ?

When assessing unconsented sites, additional costs need to be included. For example:

-

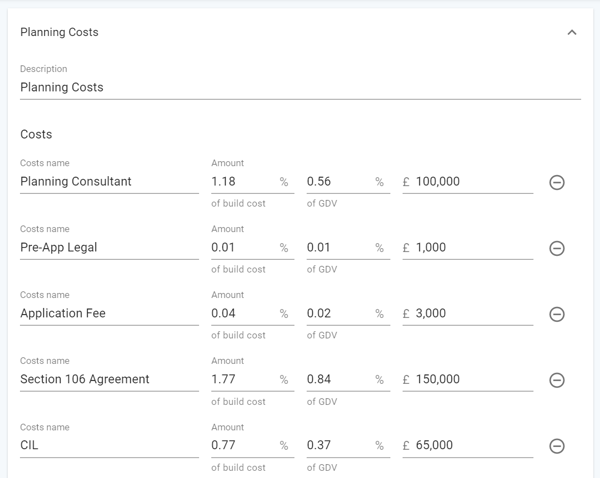

Planning costs - Pre App, Application Cost, S.106, CIL, Highways & Infrastructure

-

Professional costs - Architect fees will be higher, planning consultants

-

Surveys - flood risk assessment, drainage, environmental, topographical survey

You need to consider what your strategy is. Are you taking it through the planning process in order to sell? Are you looking for consented sites? This will dictate the assumptions that go into a development appraisal.

The target rate of return will differ, depending on what you're trying to achieve. When a developer is assessing unconsented land, they are assuming a higher risk profile. Planning is risky and takes a considerable amount of time, expertise and cost. Therefore a developer will look to achieve a higher rate or return, whether it's based on Profit on Cost, or Gross Development Value.

If a developer is looking at consented land, they may be willing to accept a lesser profit margin - because if the site has planning consent a lot of the risk to the developer has already been absorbed. The incoming developer can therefore assume that less can go wrong in delivering the end product of the completed scheme.

How does this affect the residual value of the site?

Example 1: Site without planning consent

In this example, let's say we are targeting a rate of return based on cost and we want a 28% ROC. Here is a site in Cheshire - the site is ideal for a small residential development scheme.

We've included some of the planning costs that we have assumed in order to achieve planning. We have also assumed higher professional costs such as architect fees and various professional surveys.

With the added degree of planning risk, we have assumed we are targeting a 30% Return on Cost. This arrives us at a net residual value of £3.96 million. This gives a clear indication of what we should be paying for the site. However we have agreed to pay the land owner £3.50 million. This gives us a 35% Return on Cost!

It is worth noting some developers or planning gain experts may sell the site once planning is achieved. For the purpose of this article we are assuming developers are acquiring consent and developing. We will explore planning gain in a future article.

Example 2: Site with planning consent

In this scenario we have assumed planning consent has been achieved. A significant amount of risk attached to the development has now been removed. The planning application costs have been removed from the appraisal and we have assumed the developer will accept a lower target rate of return for the site to reflect the reduced risk.

-3.png?width=600&name=image%20(1)-3.png)

-2.png?width=600&name=image%20(2)-2.png)

Leave a comment