Following on from our new revenue tool released a couple of weeks ago, we have now released another new feature that allows you to apply rental income to your projects.

This new feature is designed to make it much easier to model projects with income in addition to the sale of the completed units such as:

- The purchase of a commercial building with existing office leases with time to run before the development can commence

- The development of a residential site with existing tenants in place

- The development of a site with units that will be let out prior to the site being refinanced or sold

The key benefits here are being able to factor in rental income, and development finance requirements when looking at new projects. This will have an impact on your residual site values and also your key metrics for profit - Return on cost, return on GDV, IRR etc.

Let's run through an example project

In this example, we are going to buy a site that comprises an existing family house and a 1-acre plot of land.

The plan here is to:

- Split the land from the house

- Rent out the house while we get planning permission to build and sell 4 new build houses on the land

- Refurbish and sell the existing house

Let me walk you through this step-by-step in Aprao.

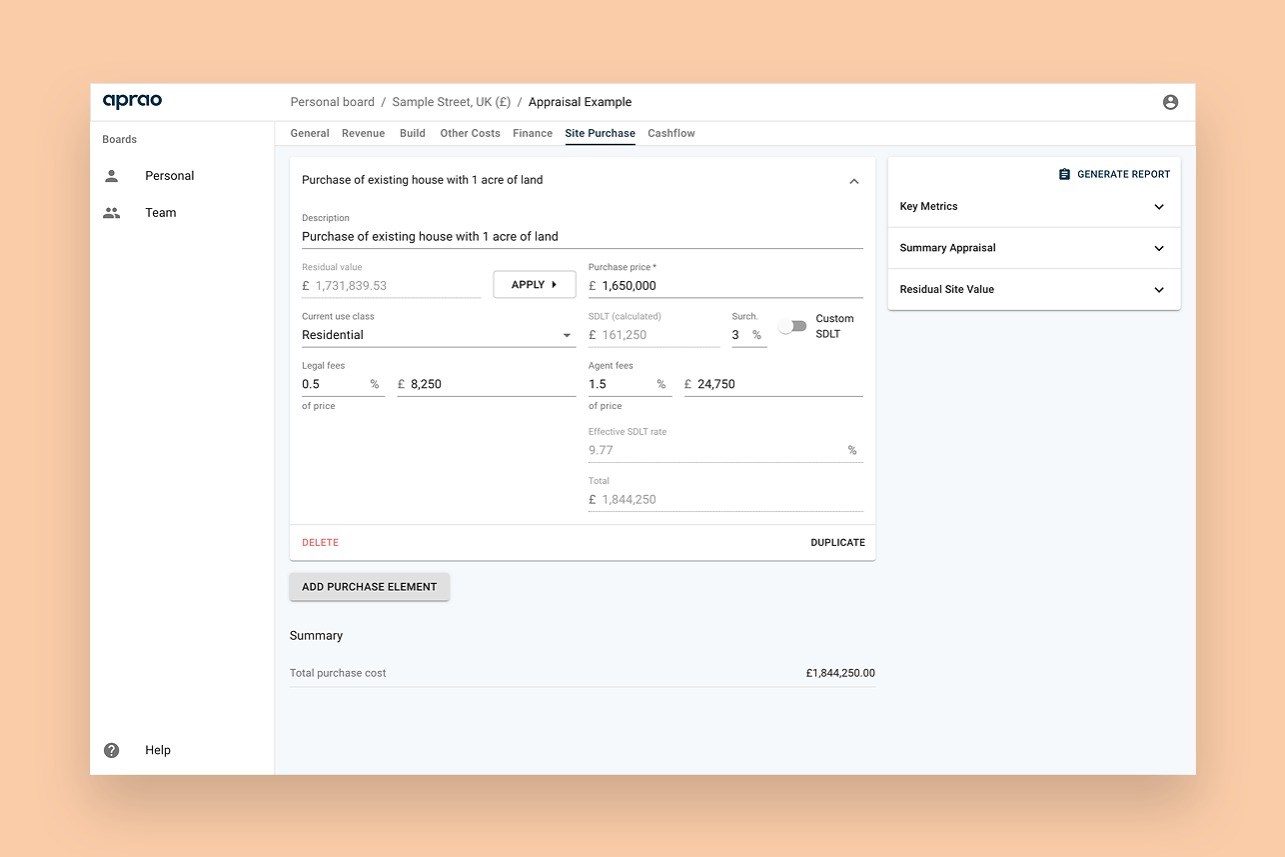

Purchasing the site

Let's start off by adding the purchase of the existing house which is on the market for £1.65m.

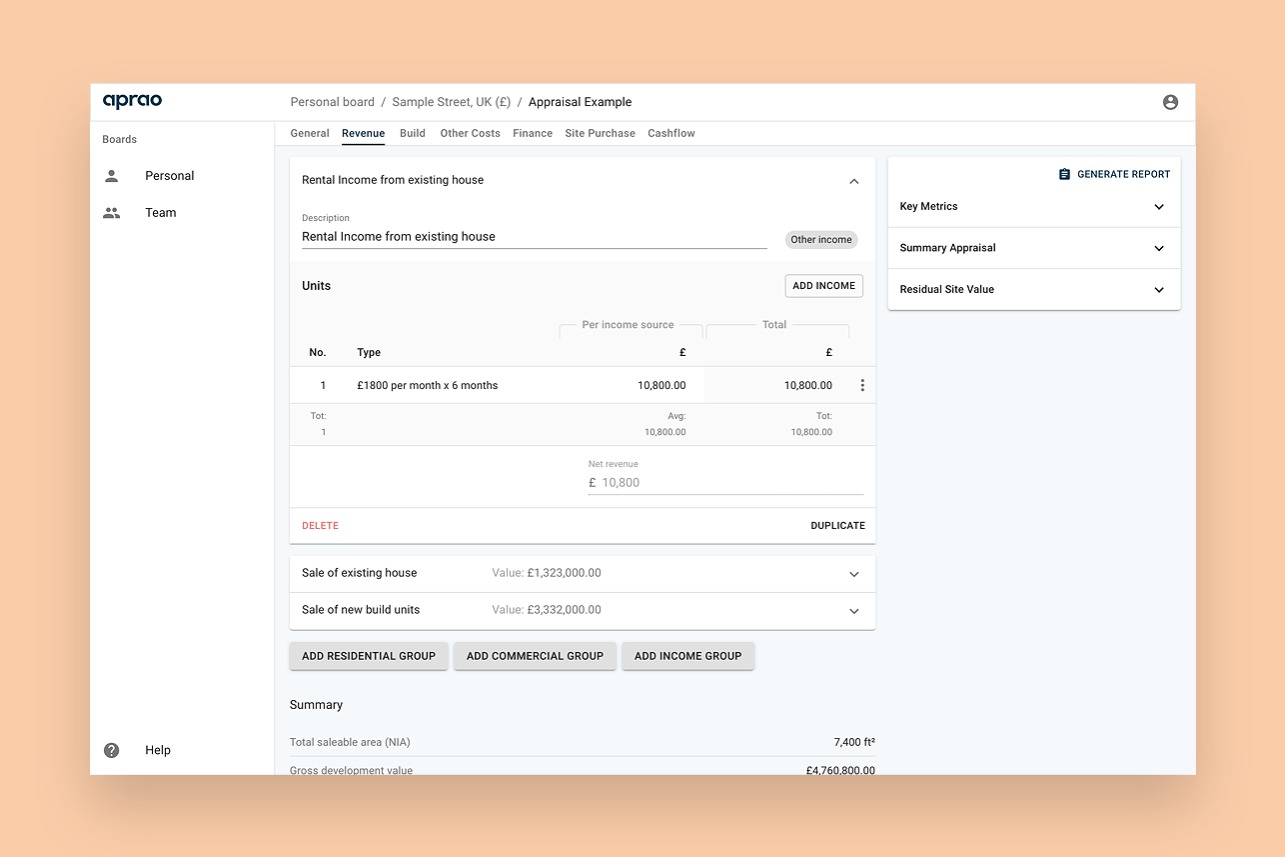

Adding the revenue

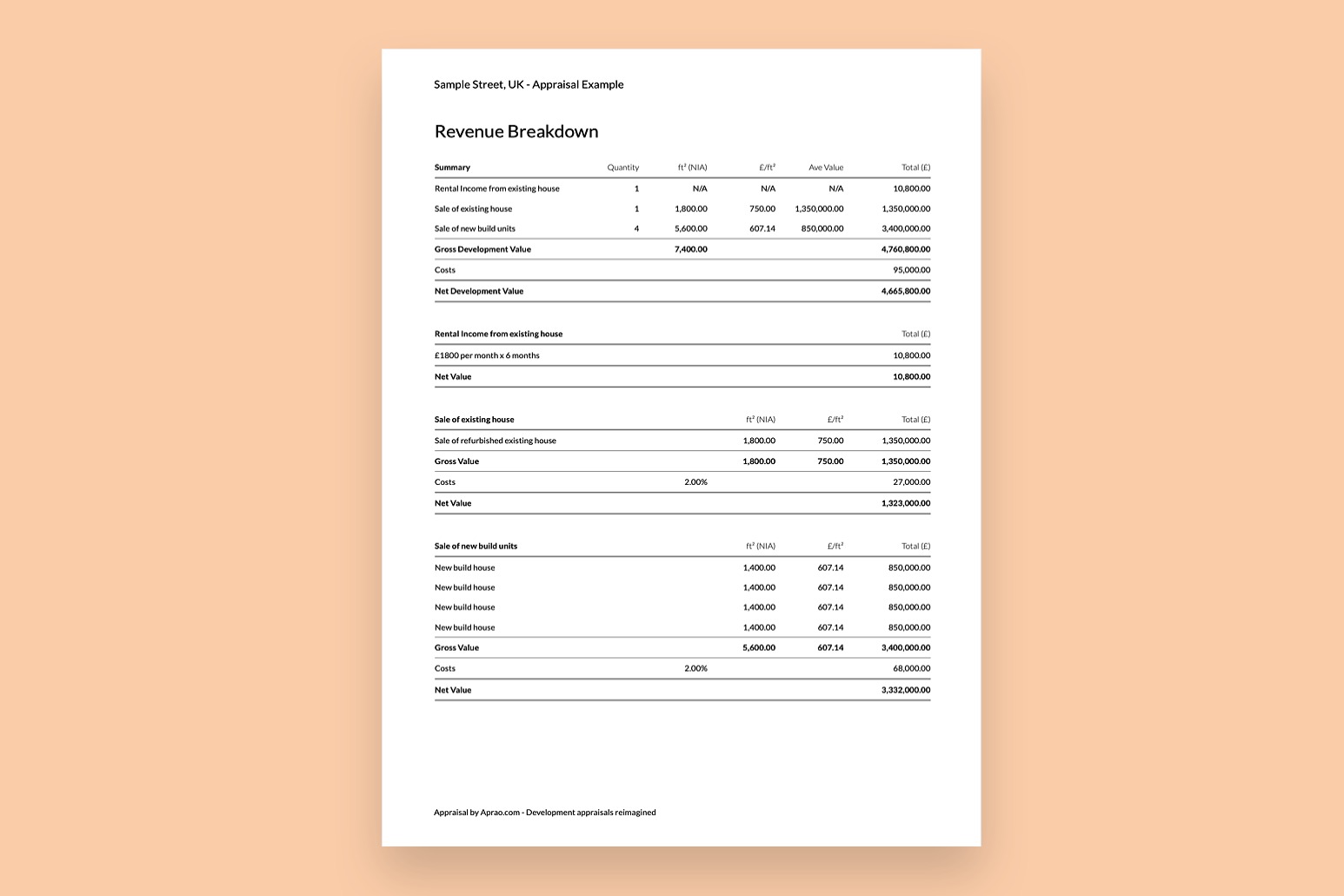

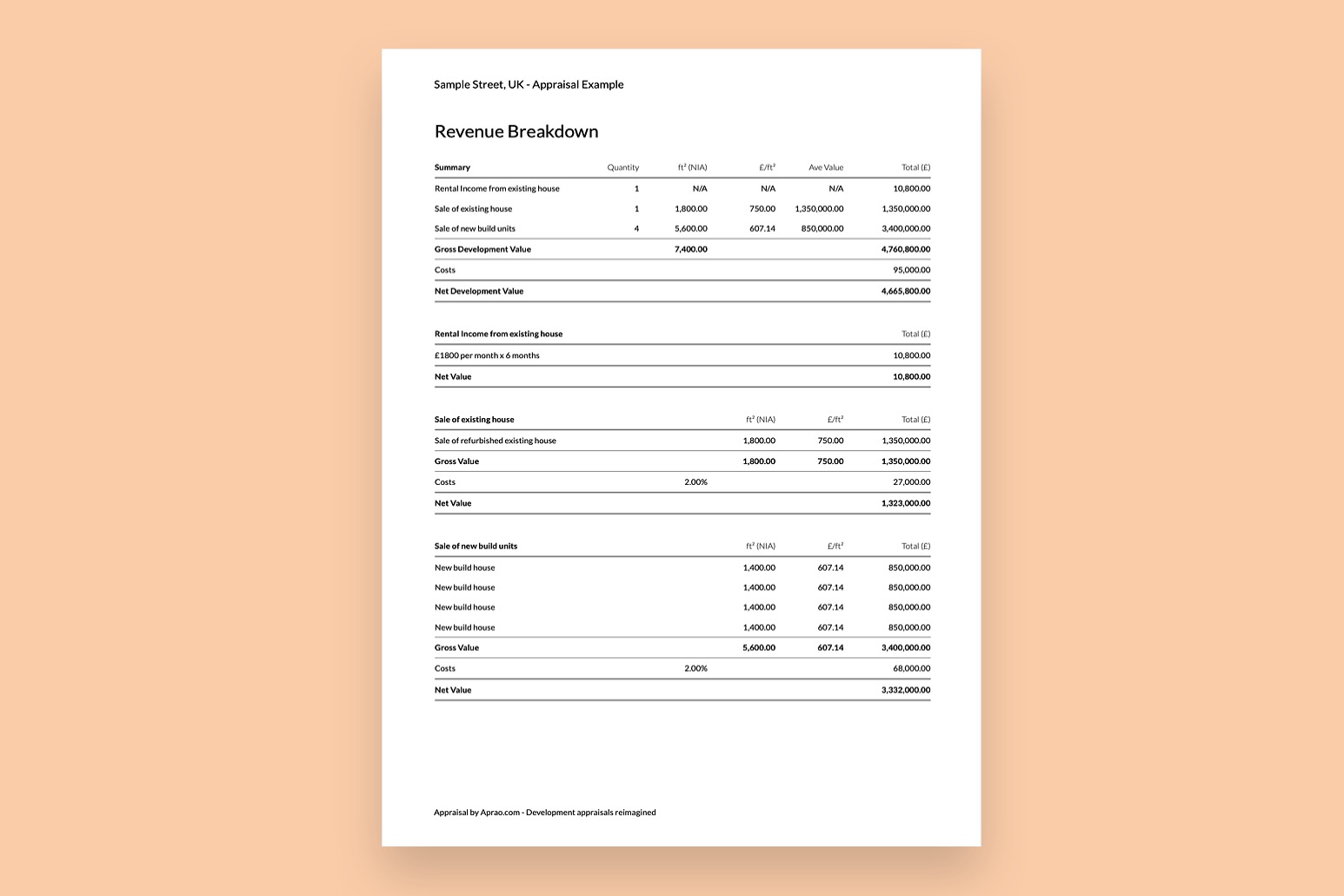

Now we're going to add the revenue into the mix. This will be made up of three types of revenue:

- Rental income from the existing house

- Sale of the refurbished existing house

- Sale of the completed 4 x new build houses

As you can see from the three buttons at the bottom of the revenue section, we now have three options - residential, commercial and income.

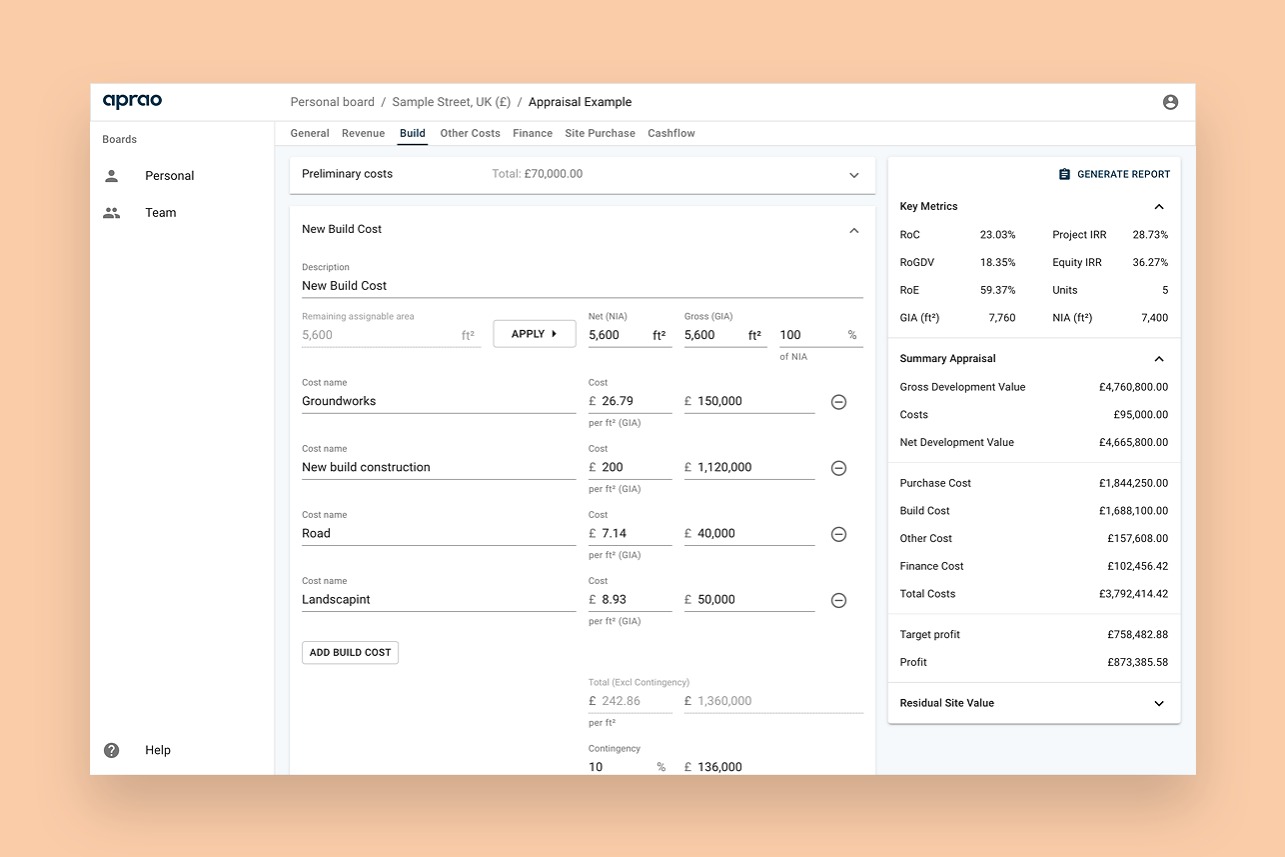

Adding the project costs

Now let's add in the build, other costs and finance for the project. We can now see the key metrics are fully populated on the right-hand side.

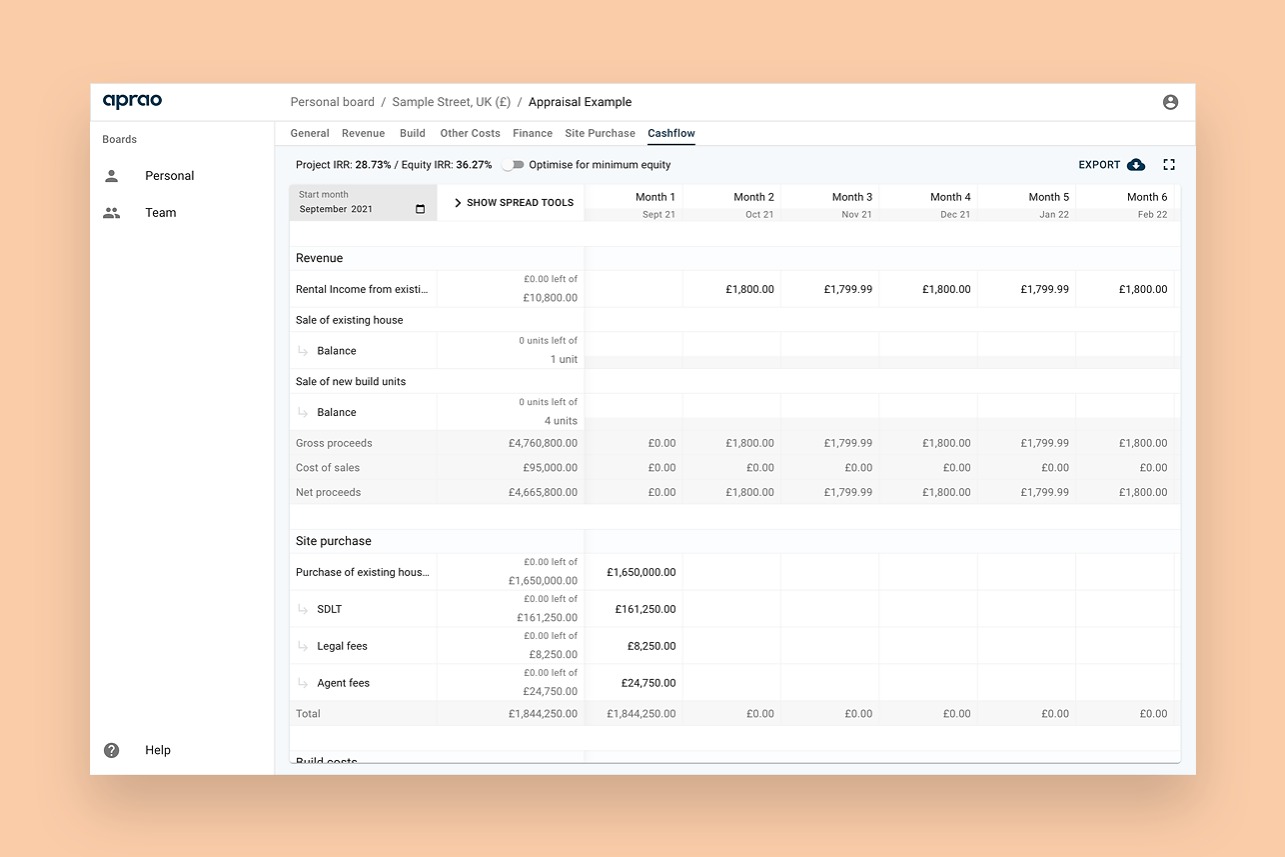

Creating a development cashflow forecast

With all of our costs in the project, we are now able to run a cash flow forecast to understand the development finance cost and our project IRRs.

In the image below you can see our rental income from the existing unit from month 2 onwards.

Bringing it all together

This all comes together in the lender-approved Aprao report. Here's an extract from the revenue breakdown page which clearly shows the revenue on the project, including our new rental income.

Summary

With the addition of rental income, you are now able to factor in many types of revenue into Aprao. Residential sales, commercial sales, non-unit sales (such as freeholds, parking spaces or additional land) and rental income.

As I am sure you can tell by now, we are constantly working on new features to make Aprao the best tool for financial modelling for real estate. Do you have a feature you would like to see? Send your ideas to support@aprao.com.

Try it for yourself!

Already use Aprao? Great! Log in now to try this out.

Not an Aprao user yet? Get started for free, no credit card required.

Leave a comment