Rolled-up interest refers to a type of interest payment structure where the interest accrued is not paid periodically (such as monthly or quarterly) but rather added to the principal amount and paid at the end of the loan term or upon completion of the development project.

How does rolled-up interest work?

With rolled-up interest, the borrower does not make regular interest payments during the loan term. Instead, the interest accumulates and 'rolls up' into the overall loan balance. This means that the borrower is not required to make interest payments out of pocket during the loan term, which can help with cash flow management, particularly for property developers who may face significant expenses throughout the project's duration.

The rolled-up interest structure can be beneficial for property developers who expect the value of the property to increase substantially during the development process. By deferring interest payments, developers can conserve their available funds for build and other costs, allowing them to maximize their investment in the project.

However, it's important to note that rolled-up interest loans often come with higher interest rates compared to traditional loans where interest payments are made periodically. This is because the lender is taking on more risk by not receiving regular interest payments.

Calculate rolled-up interest with Aprao

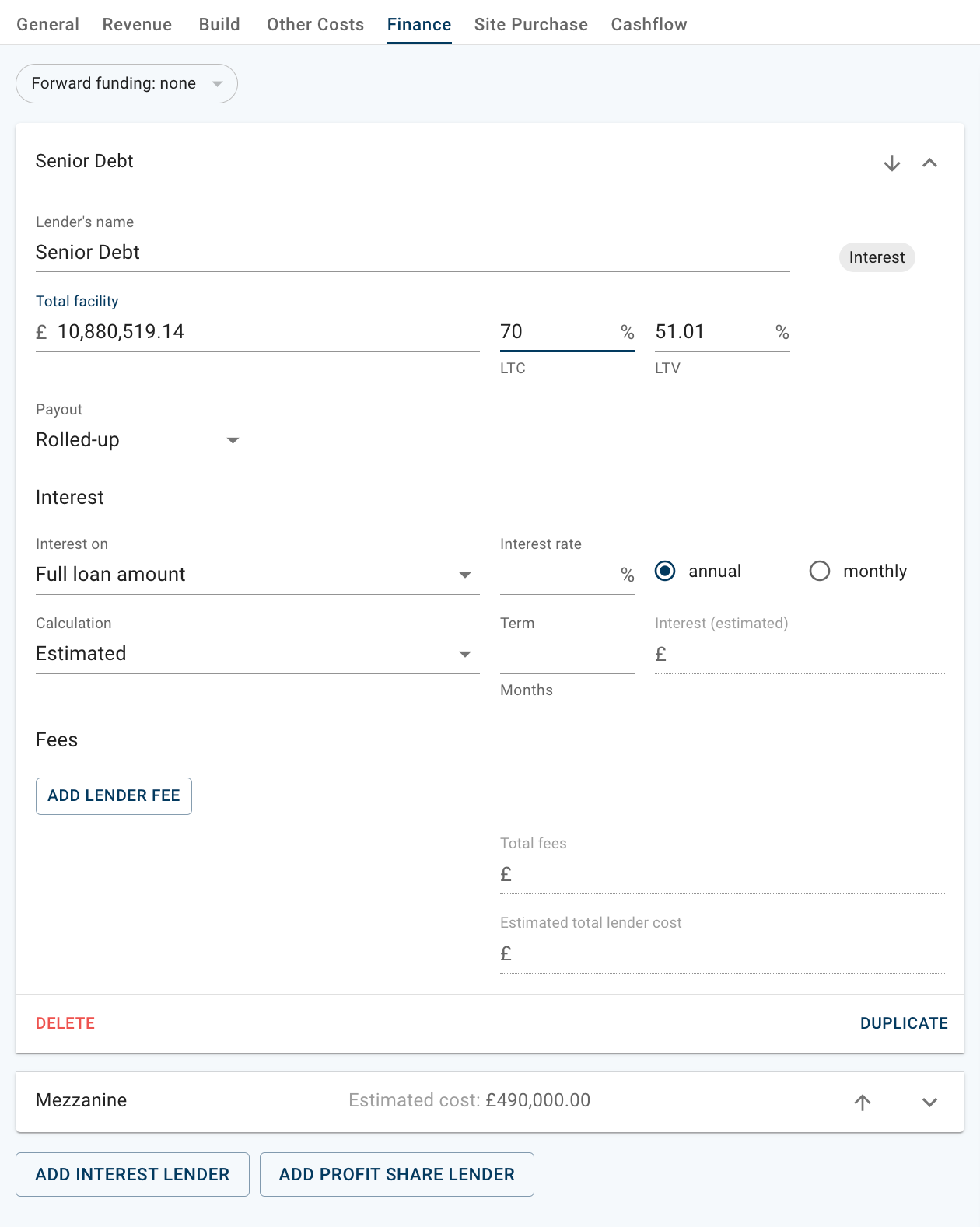

In Aprao, you get the option to choose between 'Retained', 'Rolled-up' and 'Serviced' as your loan’s interest type for interest calculation purposes. First, in the finance section, input the total facility of the loan that you are getting. Here, we assume 70% Loan-to-Cost (LTC).

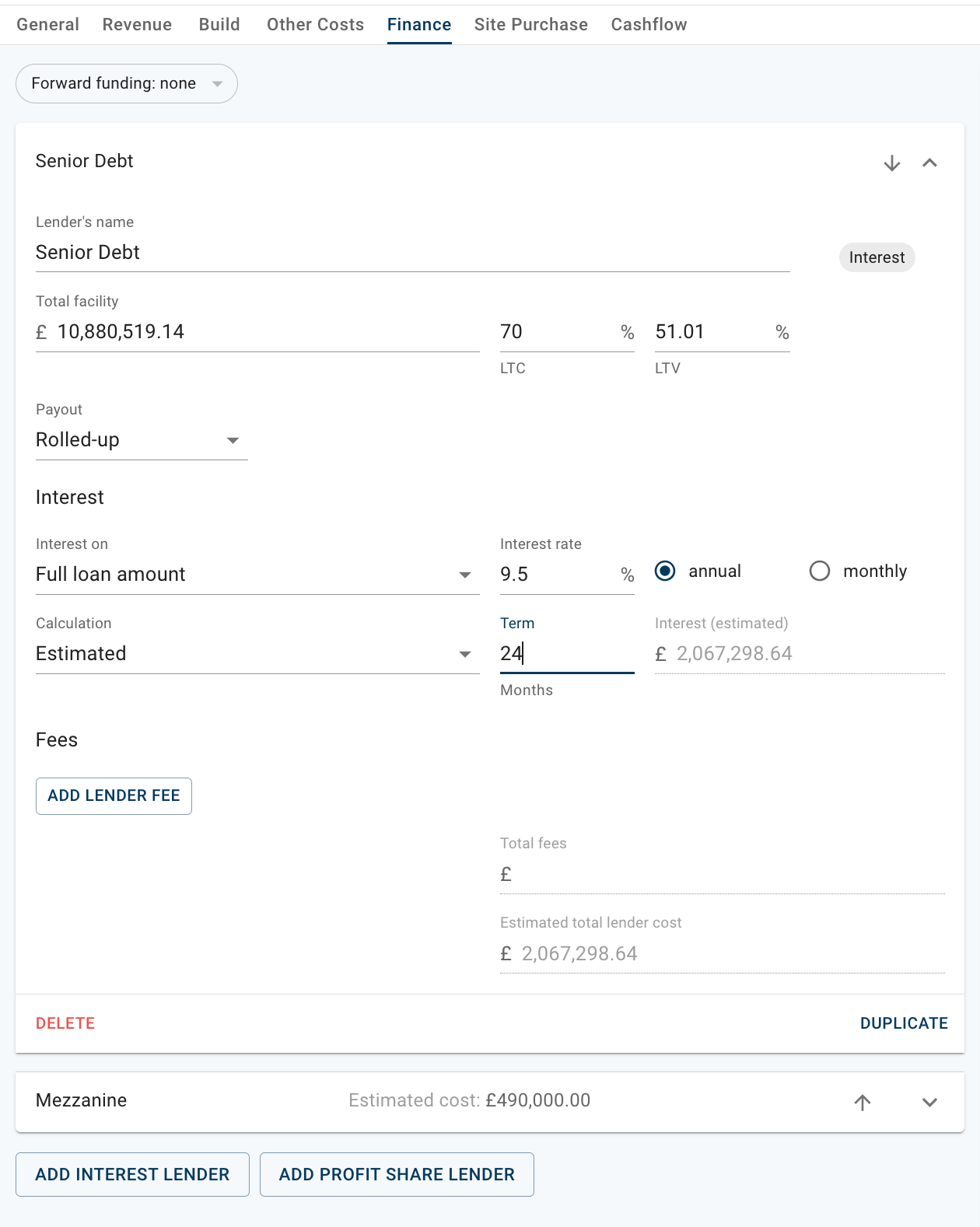

Next, based on the quote from the lender or your own assumptions, for example, if the interest is rolled-up on the full loan amount, 9.5% per annum, fixed for a term of 24 months, you simply select 'Rolled-up' under 'Payout' and then input everything into their corresponding space. The estimated interest amount will then be calculated and shown.

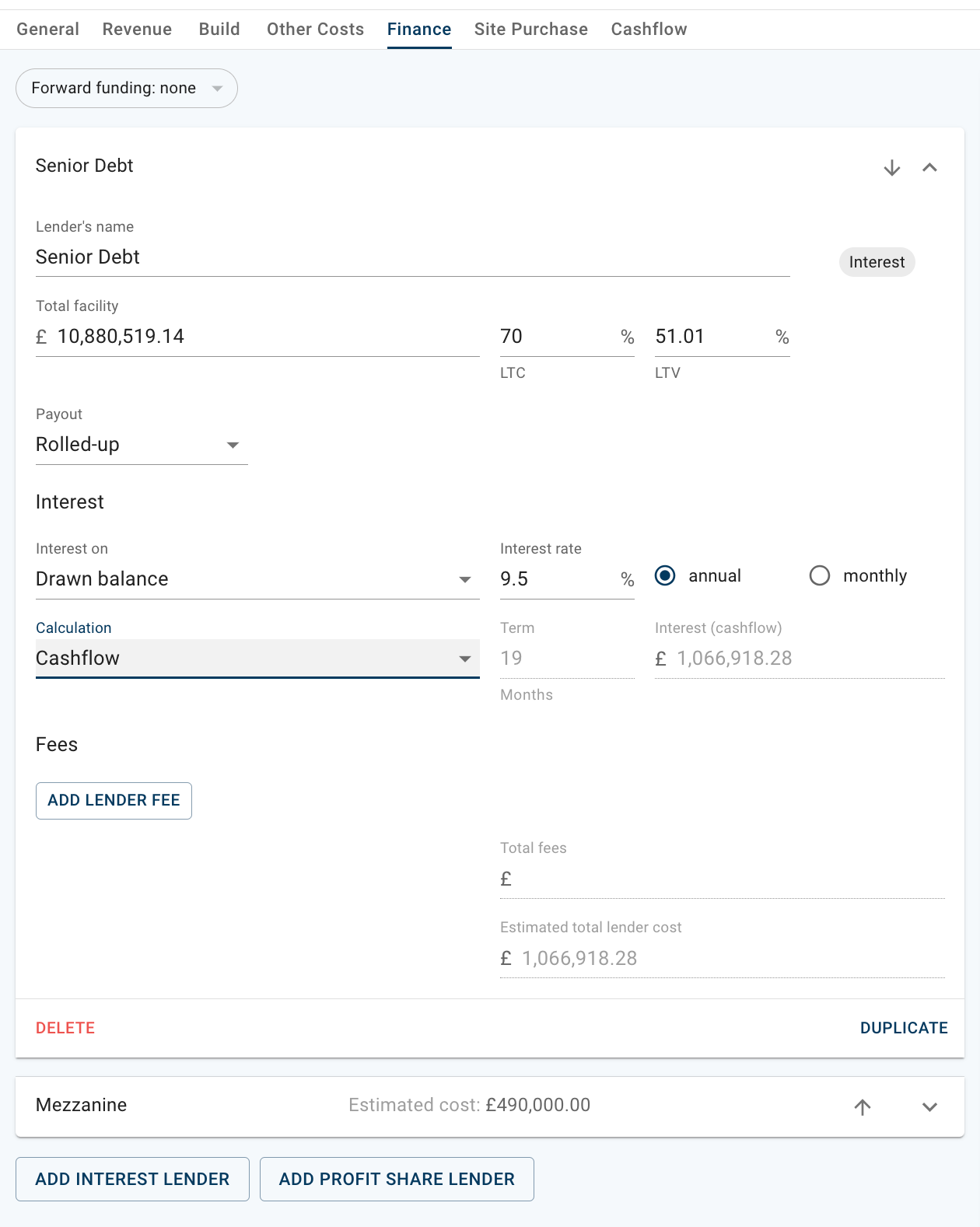

If you have a projected cashflow for your project (click here to learn more about Aprao’s smart cashflow feature), you can select 'Drawn balance' instead of 'Full loan amount' and select 'Cashflow' instead of 'Estimated' for your interest calculation. The interest calculation will then be updated based on your cashflow, which results in a more accurate estimate.

Read this case study on how timing and interest calculation methods may affect the total finance costs of a project. Read this complete guide on how to incorporate development finance into your project.

Want to follow along and create your own appraisal? Existing customers can log in here and new customers can click here to sign up for a free 14 day trial of Aprao.

Leave a comment